Not worth the money star star_border star_border star_border star_border Mwt131's Review of Banktivity Ipad Reviewed on 12/3/17 1:54 PM This app is missing a few key features, like statement reconciliation and online account setup. For use with Apple products, I am firmly in the Banktivity camp. Editing and assigning budget categories is simple and automatically assigning categories to recurring payees works smoothly. The budgeting portion was a top priority for me and is as good or better than the many I have tried. I synch bank accounts, 401k, and other investment accounts as well as American Express. I now use it exclusively and literally am always up to date across all platforms at all times. After testing Banktivity it became apparent to me, that for Mac, iPhone,and iPad capability and working together, Banktivity was far superior to Quicken. I was reluctant to change having used Quicken for so long. Quicken never quite figured out IOS or Mac. It is possible to get the same benefits offered by Banktivity for less money, but doing this requires using multiple budgeting programs.'Ĭhanged from Quicken star star star star star_border twtmd's Review of Banktivity Ipad Reviewed on 12/8/17 10:29 AM Being an Apple user for years as well as a Quicken user for over 20 years, getting something to work better with Apple products and synch seamlessly with all had been a challenge. One thing that some people will not like is the price of the software.

BANKTIVITY FOR MAC VS QUICKEN FOR MAC SOFTWARE

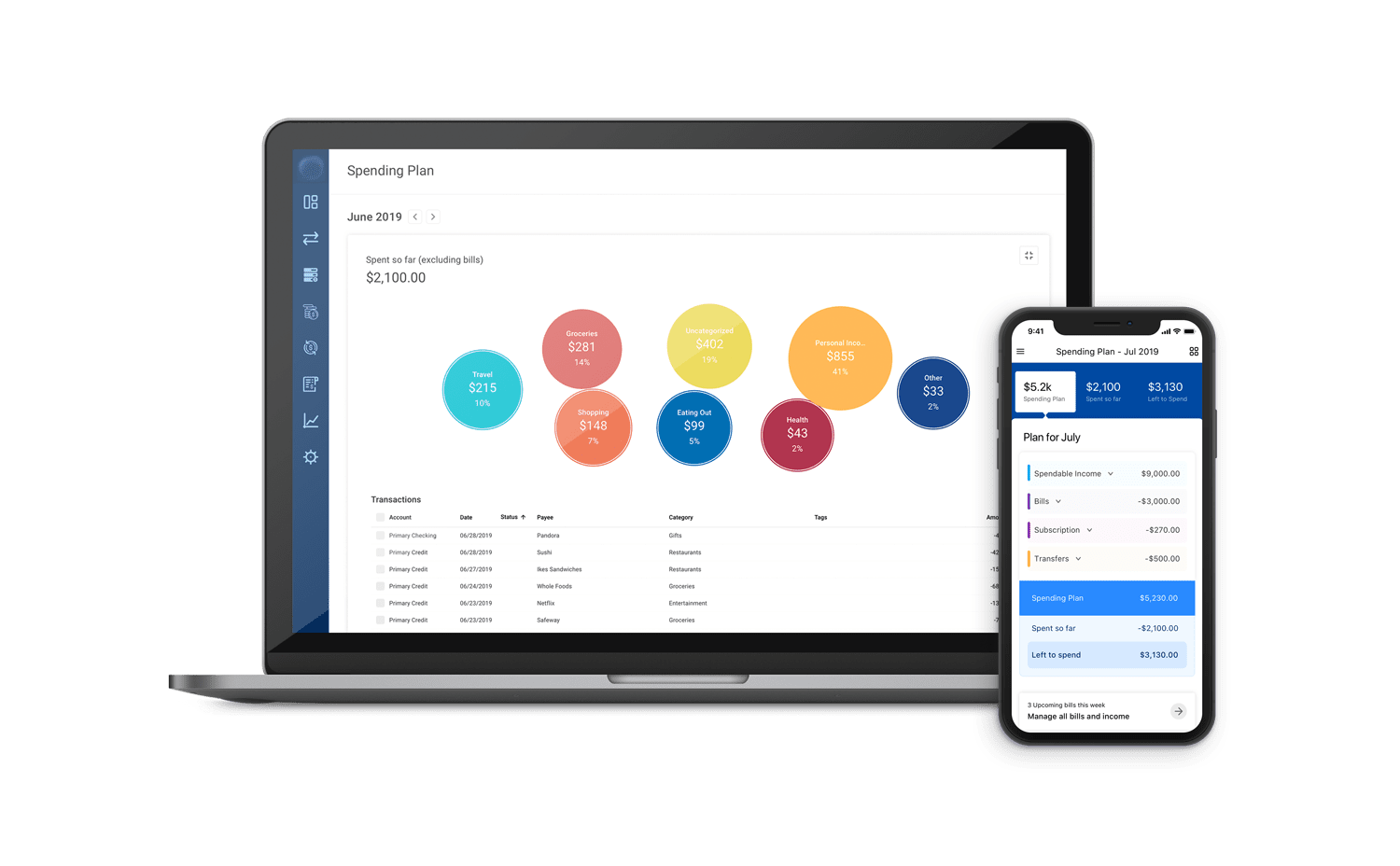

Just label the envelopes, file expenses in the right place, and the software does the rest. This works pretty much like stuffing receipts into an envelope at home. Banktivity allows for envelope budgeting. The budgeting features on the software are traditional and straightforward with one exception. There is a net worth report which will allow individuals to view their overall solvency with a single click. The reports can be saved and compared against reports from another week, month or even another year. Banktivity will do that with just a couple of clicks. Budget software is at its best when it can point out areas where spending is a problem. The report function helps to summarize spending. Create a fast food tag, enter restaurant purchases in that category, and the search results will show how much money has been spent on trips to the drive-thru in a given month. This is useful if users want to know how much they are spending on specific things. There is also a tagging function which allows users to define custom tags that can be searched. It can be customized in a couple of hours. How do you create a template on word for mac?. These workspaces are useful for getting a complete picture of one's finances. For example, a user can pull up their recent bank transactions in one workspace and view their stock portfolio in another. Banktivity incorporates workspaces to let users access multiple sections of the program simultaneously. The software must be downloaded or installed on a Mac, but once this is done the program can be synchronized with apps for iOS devices. Banktivity aims to help users reap the benefits of sound budgeting by providing an all-in-one suite of financial tools. 'When done properly, personal budgeting can be beneficial. If you’re interested in checking out macOS 10.12.6 public beta head over to Apple’s website. Like the Sierra beta, it looks to be bug fixes.

BANKTIVITY FOR MAC VS QUICKEN FOR MAC UPDATE

The update seems to be essentially just bug fixes. Apple released macOS Sierra 10.12.6 beta 6 on Wednesday, bringing us another step closer to a general release.

0 kommentar(er)

0 kommentar(er)